The Ministry of Corporate Affairs (MCA) is likely to recommend...

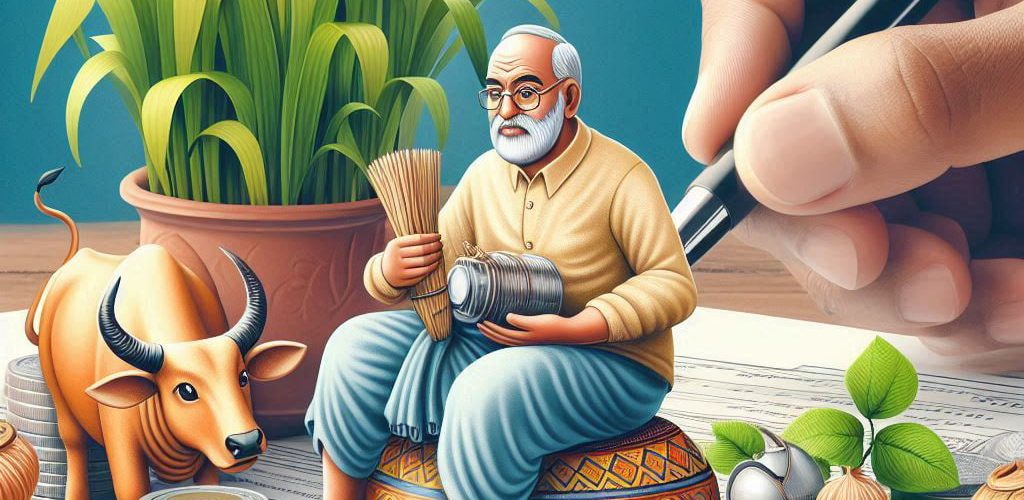

Get best assistance for easy registration on Pradhan Mantri Shram Yogi Maan-DhanYojna (PM-SYM).

Pradhan Mantri Shram Yogi Maan Dhan Yojna

Government of India has introduced a pension scheme for unorganized workers to ensure old age protection. The idea is to let workers save towards retirement. The workers in the unorganized sector with a monthly income of up to Rs 15,000 will get a pension of Rs. 3000 from the retirement age . The subscriber will have to pay a small amount of contribution during their working age. he/she should not be an income tax payer.The unorganized workers mostly engaged as home based workers, street vendors, mid-day meal workers, head loaders, brick kiln workers, cobblers, rag pickers, domestic workers, washer men, rickshaw pullers, landless labourers, own account workers, agricultural workers, construction workers, beedi workers, handloom workers, leather workers, audio- visual workers and similar other occupations.

Features

It is a voluntary and contributory pension scheme, under which the subscriber would receive the following benefits :

Minimum Assured Pension: Each subscriber under the PM-SYM, shall receive minimum assured pension of Rs 3000/- per month after attaining the age of 60 years.

Family Pension: During the receipt of pension, if the subscriber dies, the spouse of the beneficiary shall be entitled to receive 50% of the pension received by the beneficiary as family pension. Family pension is applicable only to spouse.

If a beneficiary has given regular contribution and died due to any cause (before age of 60 years), his/her spouse will be entitled to join and continue the scheme subsequently by payment of regular contribution or exit the scheme as per provisions of exit and withdrawal.

Important points

- The monthly contribution by the worker joining the scheme would be Rs 55, with matching contributions from the government.

- The contributions would rise at higher age. The worker joining the scheme at the age of 40 years would contribute Rs 200, while workers at the age of 29 years would pay Rs 100.

- The unorganized sector worker who wishes to join the scheme shall be not less than 18 years of age and not exceeding 40 years, the notification said. The worker should also have a savings bank account in his/her name and an Aadhaar number.

The scheme also provides that if a subscriber has given regular contributions and died due to any cause, his spouse shall be entitled to continue with the scheme subsequently by payment of regular contribution.- The spouse can also exit the scheme by receiving the share of contribution paid by deceased subscriber along with accumulated interest.

- In case of permanent disablement of a subscriber, his or her spouse will be entitled to continue with the scheme or exit by receiving the share of contribution, with interest.

- In case of death of a pensioner, his or her spouse shall be only entitled to receive 50 per cent of the pension.

- In case subscriber exits the scheme within a period of less than 10 years, the beneficiary’s share of contribution only will be returned to him with savings bank interest rate.

- If subscriber exits after a period of 10 years or more but before superannuation age i.e. 60 years of age, the beneficiary’s share of contribution along with accumulated interest as actually earned by fund or at the savings bank interest rate whichever is higher.

- If a subscriber has not paid the contribution continuously he/she will be allowed to regularize his contribution by paying entire outstanding dues, along with penalty charges, if any, decided by the Government.

PMSYM Scheme Eligibility

Below are the eligibility of the PMSYM Yojana :

Must be 18-40 years of age group.

Monthly Income less than Rs 15000 per month.

Not an Income tax payee.

Should not be working in the Organized Sector with a membership of EPF/NPS/ESIC

Must have a Savings Bank Account

Should have Aadhar Number

FAQ'S

What is Pradhan Mantri Shram Yogi Maan-dhan (PM-SYM) ?

Government of India has introduced a pension scheme for unorganised workers namely Pradhan Mantri Shram Yogi Maan-dhan (PM-SYM) to ensure old age protection for Unorganised Workers.

The unorganized workers mostly engaged as home based workers, street vendors, mid-day meal workers, head loaders, brick kiln workers, cobblers, rag pickers, domestic workers, washer men, rickshaw pullers, landless laborer’s, own account workers, agricultural workers, construction workers, beedi workers, handloom workers, leather workers, audio- visual workers and similar other occupations whose monthly income is Rs 15,000/ per month or less and belong to the entry age group of 18-40 years. They should not be covered under New Pension Scheme (NPS), Employees’ State Insurance Corporation (ESIC) scheme or Employees’ Provident Fund Organisation (EPFO). Further, he/she should not be an income tax payer.

What are the main features of ( PM-SYM )

Features of PM-SYM: It is a voluntary and contributory pension scheme, under which the subscriber would receive the following benefits :

(i) Minimum Assured Pension: Each subscriber under the PM-SYM, shall receive minimum assured pension of Rs 3000/- per month after attaining the age of 60 years.

(ii) Family Pension: During the receipt of pension, if the subscriber dies, the spouse of the beneficiary shall be entitled to receive 50% of the pension received by the beneficiary as family pension. Family pension is applicable only to spouse.

(iii) If a beneficiary has given regular contribution and died due to any cause (before age of 60 years), his/her spouse will be entitled to join and continue the scheme subsequently by payment of regular contribution or exit the scheme as per provisions of exit and withdrawal.

Contribution detail of ( PM-SYM )

3. Contribution by the Subscriber: The subscriber’s contributions to PM-SYM shall be made through ‘auto-debit’ facility from his/ her savings bank account/ Jan- Dhan account. The subscriber is required to contribute the prescribed contribution amount from the age of joining PM-SYM till the age of 60 years. The chart showing details of entry age specific monthly contribution is as under:

| Entry

Age |

Superannuation

Age |

Member’s

monthly contribution (Rs) |

Central Govt’s

monthly contribution (Rs) |

Total

monthly contribution (Rs) |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5)= (3)+(4) |

| 18 | 60 | 55 | 55 | 110 |

| 19 | 60 | 58 | 58 | 116 |

| 20 | 60 | 61 | 61 | 122 |

| 21 | 60 | 64 | 64 | 128 |

| 22 | 60 | 68 | 68 | 136 |

| 23 | 60 | 72 | 72 | 144 |

| 24 | 60 | 76 | 76 | 152 |

| 25 | 60 | 80 | 80 | 160 |

| 26 | 60 | 85 | 85 | 170 |

| 27 | 60 | 90 | 90 | 180 |

| 28 | 60 | 95 | 95 | 190 |

| 29 | 60 | 100 | 100 | 200 |

| 30 | 60 | 105 | 105 | 210 |

| 31 | 60 | 110 | 110 | 220 |

| 32 | 60 | 120 | 120 | 240 |

| 33 | 60 | 130 | 130 | 260 |

| 34 | 60 | 140 | 140 | 280 |

| 35 | 60 | 150 | 150 | 300 |

| 36 | 60 | 160 | 160 | 320 |

| 37 | 60 | 170 | 170 | 340 |

| 38 | 60 | 180 | 180 | 360 |

| 39 | 60 | 190 | 190 | 380 |

| 40 | 60 | 200 | 200 | 400 |

Contribution by the Central Government:

Matching contribution by the Central Government: PM-SYM is a voluntary and contributory pension scheme on a 50:50 basis where prescribed age-specific contribution shall be made by the beneficiary and the matching contribution by the Central Government as per the chart. For example, if a person enters the scheme at an age of 29 years, he is required to contribute Rs 100/ – per month till the age of 60 years an equal amount of Rs 100/- will be contributed by the Central Government.

Enrolment Process under PM-SYM:

Enrolment Process under PM-SYM: The subscriber will be required to have a mobile phone, savings bank account and Aadhaar number. The eligible subscriber may visit the nearest Common Services Centres (CSC eGovernance Services India Limited (CSC SPV)) and get enrolled for PM-SYM using Aadhaar number and savings bank account/ Jan-Dhan account number on self-certification basis. Later, facility will be provided where the subscriber can also visit the PM-SYM web portal or can download the mobile app and self-register using Aadhaar number/ savings bank account/ Jan-Dhan account number on self-certification basis.

Enrollment agencies:

Enrollment agencies: The enrolment will be carried out by all the Common Services Centres. The unorganized workers may visit their nearest CSC along with their Aadhaar Card and Savings Bank account passbook/Jandhan account and get registered themselves for the Scheme. Contribution amount for the first month shall be paid in cash for which they will be provided with a receipt.

Facilitation Centres

Facilitation Centres: All the branch offices of LIC, the offices of ESIC/EPFO and all Labour offices of Central and State Governments will facilitate the unorganized workers about the Scheme, its benefits and the procedure to be followed, at their respective centres. In this respect, the arrangements to be made by all offices of LIC, ESIC, EPFO all Labour offices of Central and State Governments are given below, for ease of reference: 1. All LIC, EPFO/ESIC and all Labour offices of Central and State Governments may set up a “Facilitation Desk” to facilitate the unorganized workers, guide about the features of the Scheme and direct them to nearest CSC 2. Each desk may consist of at least one staff. 3. They will have backdrop, stand at the main gate and sufficient number of brochures printed in Hindi and regional languages to be provided to the unorganized workers. 4. Unorganized workers will visit these centres with Aadhaar Card, Savings bank account/Jandhan account and mobile phone. 5. Help desk will have onsite suitable sitting and other necessary facilities for these workers. 6. Any other measures intended to facilitate the unorganized workers about the Scheme, in their respective centres.

Fund Management

Fund Management: PM-SYM will be a Central Sector Scheme administered by the Ministry of Labour and Employment and implemented through Life Insurance Corporation of India and CSC eGovernance Services India Limited (CSC SPV). LIC will be the Pension Fund Manager and responsible for Pension pay out. The amount collected under PM-SYM pension scheme shall be invested as per the investment pattern specified by Government of India.

Exit and Withdrawal

Exit and Withdrawal: Considering the hardships and erratic nature of employability of these workers, the exit provisions of scheme have been kept flexible. Exit provisions are as under:

(i) In case subscriber exits the scheme within a period of less than 10 years, the beneficiary’s share of contribution only will be returned to him with savings bank interest rate.

(ii) If subscriber exits after a period of 10 years or more but before superannuation age i.e. 60 years of age, the beneficiary’s share of contribution along with accumulated interest as actually earned by fund or at the savings bank interest rate whichever is higher.

(iii) If a beneficiary has given regular contributions and died due to any cause, his/ her spouse will be entitled to continue the scheme subsequently by payment of regular contribution or exit by receiving the beneficiary’s contribution along with accumulated interest as actually earned by fund or at the savings bank interest rate whichever is higher.

(iv) If a beneficiary has given regular contributions and become permanently disabled due to any cause before the superannuation age, i.e. 60 years, and unable to continue to contribute under the scheme, his/ her spouse will be entitled to continue the scheme subsequently by payment of regular contribution or exit the scheme by receiving the beneficiary’s contribution with interest as actually earned by fund or at the savings bank interest rate whichever is higher.

(v) After the death of subscriber as well as his/her spouse, the entire corpus will be credited back to the fund.

(vi) Any other exit provision, as may be decided by the Government on advice of NSSB.

Doubt and Clarification:

Book Service Now

Recent Post

An India court ruling forcing Tiger Global Management to pay...

The contract is valued at around ₹3,000 crore and will...

Boards and management of companies using artificial intelligence tools for...

The Supreme Court’s ruling in the Tiger Global case has...

In a landmark ruling on international tax-treaty use by the...

Coupled with higher raw material costs, this situation is set...

As many taxpayers have still been waiting for their refunds,...

Corporate mergers and amalgamations can trigger tax liabilities for shareholders...

This decision overturns a 2011 Gujarat High Court judgment, clarifying...

New Delhi: India is weighing a proposal to extend a...

New Delhi: In a relief to companies operating heavy industrial...

The National Financial Reporting Authority (NFRA) has flagged systemic non-compliance...

The Centre is considering extension of the tax deferral on...

On October 31, 2025, the Income Tax Appellate Tribunal (ITAT)...

New Delhi, Public trust in tax remains strongest in Asia...

Credit growth in the country is expected to remain at...

Old income tax demands, going back to 2009-11 or even...

The Institute of Chartered Accountants of India (ICAI) has deferred...

The gross Goods and Services Tax collections for December 2025...

The Institute of Chartered Accountants of India has released an...

With just over a month to go until Budget 2026,...

Indian companies will be required to immediately expense higher gratuity...

New Delhi: India and the European Union are slated to...

Indian residents can invest in outbound US dollar denominated mutual...

Colgate-Palmolive (India) said on Friday it has received a tax...

Calendar year 2025 saw a series of regulatory, standard-setting and...

New Delhi: The Delhi High Court on Wednesday expressed displeasure...

Representative image Nearly a decade after its rollout, the Goods...

UltraTech is the country’s leading cement maker, with a capacity...

Chinese-owned smartphone maker Oppo Mobiles India Pvt Ltd paid ₹1,579...

The National Financial Reporting Authority has raised concerns over how...

India’s net direct tax collections rose 8% to Rs 17.05...

ICICI Bank India’s second largest private banker ICICI bank on...

India’s audit rulebook is poised for a significant regulatory reset,...

Vivek Anand The government’s decision to rationalise GST rates on...

The Central Board of Direct Taxes has uncovered significant misuse...

New Delhi, InterGlobe Aviation, which operates the IndiGo airline, on...

NEW DELHI: India and France have struck a deal to...

The Institute of Chartered Accountants of India (ICAI) has approved...

Pune: Chartered accountants have played a vital role to ensure...

India’s audit regulator has issued a sweeping indictment of audit...

Deloitte India on Tuesday launched an artificial intelligence (AI)-powered platform,...

The government is on track to meet the fiscal deficit...

NEW DELHI: Income-tax refunds are facing unusual delays this assessment...

Finance minister Nirmala Sitharaman on Tuesday said the recent goods...

NEW DELHI: The Supreme Court on Thursday held that leasing...

Finance Minister Nirmala Sitharaman on Thursday said the proposed Health...

The National Financial Reporting Authority (NFRA) is organising nationwide outreach...

India’s Goods and Services Tax (GST) mop-up in November posted...

New Delhi: Lok Sabha proceedings were adjourned for the day...

India is planning to extend the tax holiday on profits...

The Supreme Court on Friday rapped the Income Tax Department...

Diageo and Pernod Ricard’s Indian lobbying group has sued Maharashtra...

Tesla The Delhi High Court has granted interim injunction in...

As the conversation heats up around whether artificial intelligence is...

Income Tax Department’s Exemptions wing, Principal Chief Commissioner Debjyoti Das...

The Indian passenger car market is finally picking up pace,...

Hyderabad, Two persons have been arrested for allegedly being part...

A series of cases of fraud at companies like IndusInd...

The power regulator has directed renewable energy developers to reconcile...

New Delhi: Goods and services tax (GST) collection this month...

New Delhi, The National Financial Reporting Authority (NFRA), the independent...

Life Insurance Corporation (LIC) has urged the government to make...

Demand for household products and groceries revived in the second...

Mumbai: After years of investment in automation, the Big Four...

New Delhi, Sanjay Kumar Agarwal, Chairman, Central Board of Indirect...

The Supreme Court, in a recent ruling, has held that...

Manoj Gaur The Enforcement Directorate has arrested Manoj Gaur, MD...

India’s life insurance industry recorded a sharp revival in October...

Nangia Andersen India Pvt Ltd has decided to end its...

Bengaluru, In a move that can improve the speed and...

India working on multilateral tax certainty framework, says principal commissioner Income Tax, ETCFO

India’s recent tax reforms have strengthened investor confidence and reduced...

The Central Board of Direct Taxes (CBDT), issued a notification...

R Doraiswamy, MD & CEO, LIC of India The country’s...

The government has rolled out a Simplified Goods and Services...

The Bombay High Court has observed that the income tax...

While filing your income tax return and claiming tax exemptions,...

The government is reviewing public procurement norms to make them...

India needs to move towards a principle-based, technology-enabled, and trust-anchored...

India’s gross Goods and Services Tax (GST) collections rose 4.6%...

The Associated Chambers of Commerce and Industry of India (ASSOCHAM)...

New Delhi [India], October 29 (ANI): The PHD Chamber of...

The Institute of Chartered Accountants of India (ICAI) has proposed...

The National Financial Reporting Authority (NFRA) has expanded the scope...

Mumbai: A splitting of hairs over ‘may’ and ‘shall’, the...

Finance Minister Nirmala Sitharaman on Friday called on Goods and...

Hailing the new Goods and Services Tax (GST) reforms, Prime...

The Indian government is considering major reforms in the accounting...

New Delhi: Most salon chains, fitness centres, gyms and yoga...

Seeking to further improve quality, the chartered accountants’ body ICAI‘s...

An analysis by Crisil Ratings of 40 organised apparel retailers,...

Eternal, which owns the Zomato and Blinkit brands, on Sunday...

India’s chartered accountancy sector is seeing increasing workforce concentration in...

TRAI issues draft amendments to Telecommunication Tariff Order and Accounting...

An initial probe by the Mumbai Police’s Economic Offences Wing...

The Financial Reporting Review Board (FRRB) of the Institute of...

The Institute of Chartered Accountants of India (ICAI) is expected...

SC seeks replies of Centre, SEBI on Sahara firm’s plea...

The Bombay High Court has granted an interim stay in...

Product's And Service's

Startup India

Pension Withdrawal

Hand Writing Improvement Kit (English)+ courier charges

Hand Writing Improvement Kit (Hindi) + courier charges

e-Shram Card

-

Latest Laptop deal

(Refurbished Premium) ASUS Certified Refurbished ROG Strix G16 (2023) 64WHrs Battery, Intel Core i5-13450HX 13th Gen, 16-inch FHD+ 165Hz, 6GB RTX 3050, (16GB/1TB SSD/Windows 11/Office 2021/Gray/2.50 Kg)

₹98,490.00Original price was: ₹98,490.00.₹86,500.00Current price is: ₹86,500.00. Buy Now -

Latest Laptop deal

(Refurbished) ASUS TUF Gaming F17 (2022), 17.3″(43.94 cms) FHD 144Hz, Intel Core i5-12500H 12th Gen, RTX 3050 4GB GPU, Gaming Laptop (16GB/512GB SSD/90WHr Battery/Windows 11/Gray/2.6 Kg), FX707ZC4-HX067W

₹70,990.00Original price was: ₹70,990.00.₹60,341.00Current price is: ₹60,341.00. Buy Now -

Latest Laptop deal

(Refurbished) Dell 15 Laptop, 12th Gen Intel Core i5-1235U Processor, 8GB, 512GB SSD, 15.6″ (39.62cm) FHD Display, Win 11 + MSO’21, 15 Month McAfee Antivirus, Black, Spill-Resistant Keyboard, Thin & Light- 1.66kg

₹43,990.00Original price was: ₹43,990.00.₹39,591.00Current price is: ₹39,591.00. Buy Now -

Latest Laptop deal

(Refurbished) Dell Latitude 5290 7th Gen Intel Core i5 Thin & Light HD Laptop (16 GB DDR4 RAM/256 GB SSD/12.5″ (31.8 cm) HD/Windows 11/MS Office/WiFi/BT/Intel UHD Graphics)

₹89,999.00Original price was: ₹89,999.00.₹16,999.00Current price is: ₹16,999.00. Buy Now